Beat the market when the market has beaten you

Optimism feels justified as more economies start to move through the worst of the COVID-19 recession and reopen. Now the debates clearly shifts from the depth of the contraction to the shape of the recovery. We are thrown headfirst into the alphabet soup of scenarios – V, U, L and W. The one constant across the various scenarios is uncertainty. How do you construct an investment portfolio that is protected from another dip but does not sacrifice unrealised market recoveries? More importantly, how do you still achieve your clients’ long-term savings goals without further capital loss?

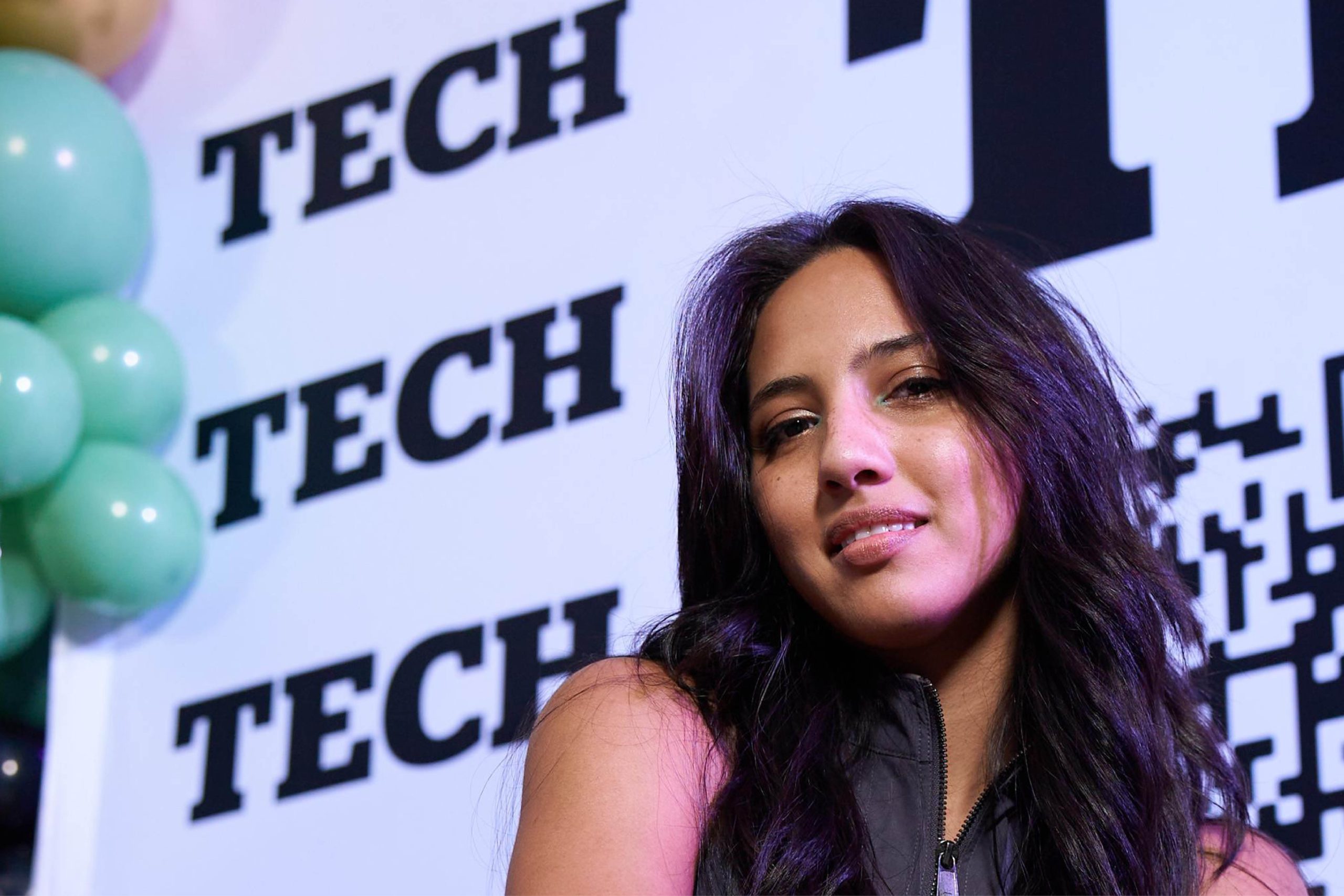

Lourens Pretorius, Co-Portfolio Manager for the Amplify SCI* Defensive Balanced Fund and Amplify SCI* Absolute Fund, discusses the use of tactical asset allocation and hedging structures to consistently deliver real returns during volatile times.

*Sanlam Collective Investments