The job of an asset allocator is often agonising. In search of the holy grail, where their carefully selected combination of asset classes or funds produce superior returns with limited volatility, they must simultaneously comprehend the market’s many moving parts; piece together a portfolio where each building block plays nicely with its neighbours; and then deploy a white-knuckled grip on the railings of their conviction as the market dances to its volatile tune.

Those who have clients with income needs face a particularly pressing asset allocation question; where do I find suitable yield in the prevailing low interest rate environment? A potential solution is to switch from income funds, which currently yield between 6-7%, into bonds funds that offer anywhere from 9-11%. That’s a yield pick-up not to be scoffed at. However, whether or not it should be taken advantage of, largely depends on who the asset allocator is.

A finger on the pulse

On average, South African bond funds have duration equal to three times that of their multi-asset income fund counterparts. That makes their portfolio values much more sensitive to changes in inflation expectations and interest rate movements. This increased risk partly explains the yield differential.

As you’d expect, the higher duration bond funds carry greater potential for capital gains and losses. Asset allocators, whose clients have a low ability and willingness to take risk, might choose to avoid bond funds on this basis.

However, with two specific prerequisites in place, they may be able to justify including them as a building block in their solutions. Those conditions are as follows:

- The asset allocator is sufficiently immersed in the economic, business, and investment cycles to be able to establish conviction on both the direction and timing of interest rate movements, as well as the trajectory of the global risk-on/ risk-off zeitgeist

- Overall portfolio risk can be kept at an acceptable level by reducing exposure to riskier building blocks like equity funds.

The first point is the trickiest to deliver on. Why is such a capability necessary?

Bond funds must hold a minimum number of underlying bonds at all times. That means they cannot meaningfully reduce their duration. To avoid losses in a rising interest rate or risk-off environment, asset allocators would have to consider selling units of the bond fund or binning it outright.

Of course, if the bond fund forms part of a solution where the investor has a longer investment horizon and a higher tolerance for risk, then selling may not be necessary.

This ability to perform tactical switches between building blocks (alluded to in the second point) is particularly important in an emerging market context like South Africa. Our inflation and interest rates – the primary drivers of capital gains or losses in a bond fund – are vulnerable to sudden changes in direction that can then persist for multi-year periods, much the same way that our currency is.

If the cycle turns hostile towards duration for an extended period of time, the attractive yields may be overshadowed by capital losses.

No fireworks expected

One of the benefits of using a bond fund, from the perspective of an asset allocator, is that the universe is largely homogenous; returns are unlikely to diverge meaningfully between one fund and the next, ceteris paribus. That brings valuable predictability in the context of portfolio construction.

In a rising interest rate or risk-off environment – where duration-heavy bond funds would be undesirable – asset allocators who see these two strategies as fungible can switch to income funds that exhibit similar predictability.

For example, some South African income funds are primarily exposed to floating rate credit. That means they take on negligible duration in earning their yield. Others invest in short-maturity, low-duration, high-yielding bonds to similar effect. The cash-plus benchmarks that these income funds are pitted against send a clear message to the asset allocators wielding them – don’t expect any fireworks.

Building blocks that behave in a predictable manner are a good fit for asset allocators who have the tactical toolkit to make timeous fund switches.

However, for those asset allocators who may be unsure about their ability to consistently call the interest rate and risk cycle, in order to execute successful bond fund forays, there’s a type of income fund that might be more suitable.

Through-the-cycle income

Some commentators may argue that income funds shouldn’t actively trade duration. And, in the context of an individual investor looking for a low volatility income stream, they have a point when considering funds in the Money Market or Short-Term ASISA categories.

But it’s a different story for asset allocators who want an income-generating building block they can hold through the cycle. Rather than timing the switch between income and bond funds, they turn to managers of the former who exhibit a demonstrable willingness to flex their asset allocation in order to capture duration when the environment calls for it, and vice versa. Some of which can be found in the ASISA Multi Asset Income category.

The resulting portfolio construction is fluid, agnostic to peer and benchmark weightings, and heavily influenced by the manager’s intricate view of the economic, business, and investment cycles. A preference for quality, liquid investments also makes it easier to implement effective diversification.

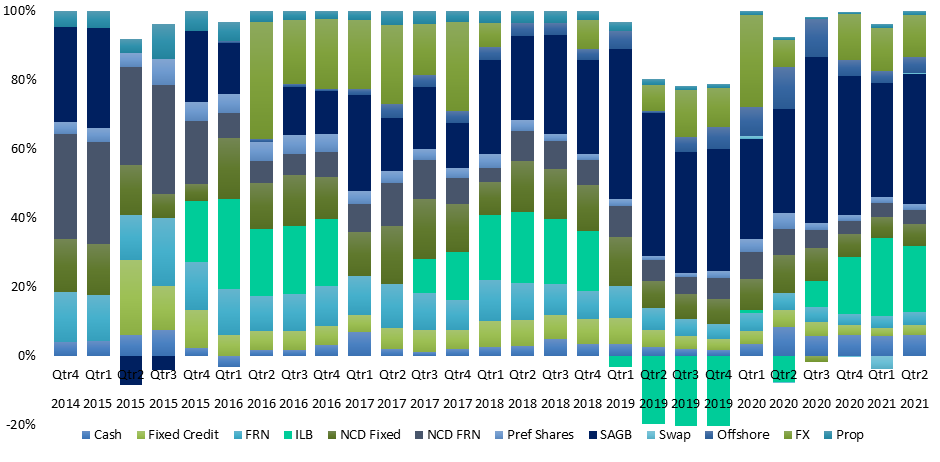

To achieve the latter, the fund manager must know their way around more than just bond and cash instruments. Forex, swaps, preference shares, floating rate notes (FRNs), negotiable certificate of deposit (NCDs), inflation-linked bonds (ILBs), offshore, and property; all must sit comfortably inside their wheelhouse. To be sure, it’s a hefty skillset.

The graphic below illustrates the true scope and flexibility that South African multi-asset income funds have at their potential disposal. No asset class is exempt from being reduced to near zero. And with enough conviction, those same asset classes may materially exceed industry-average weightings.

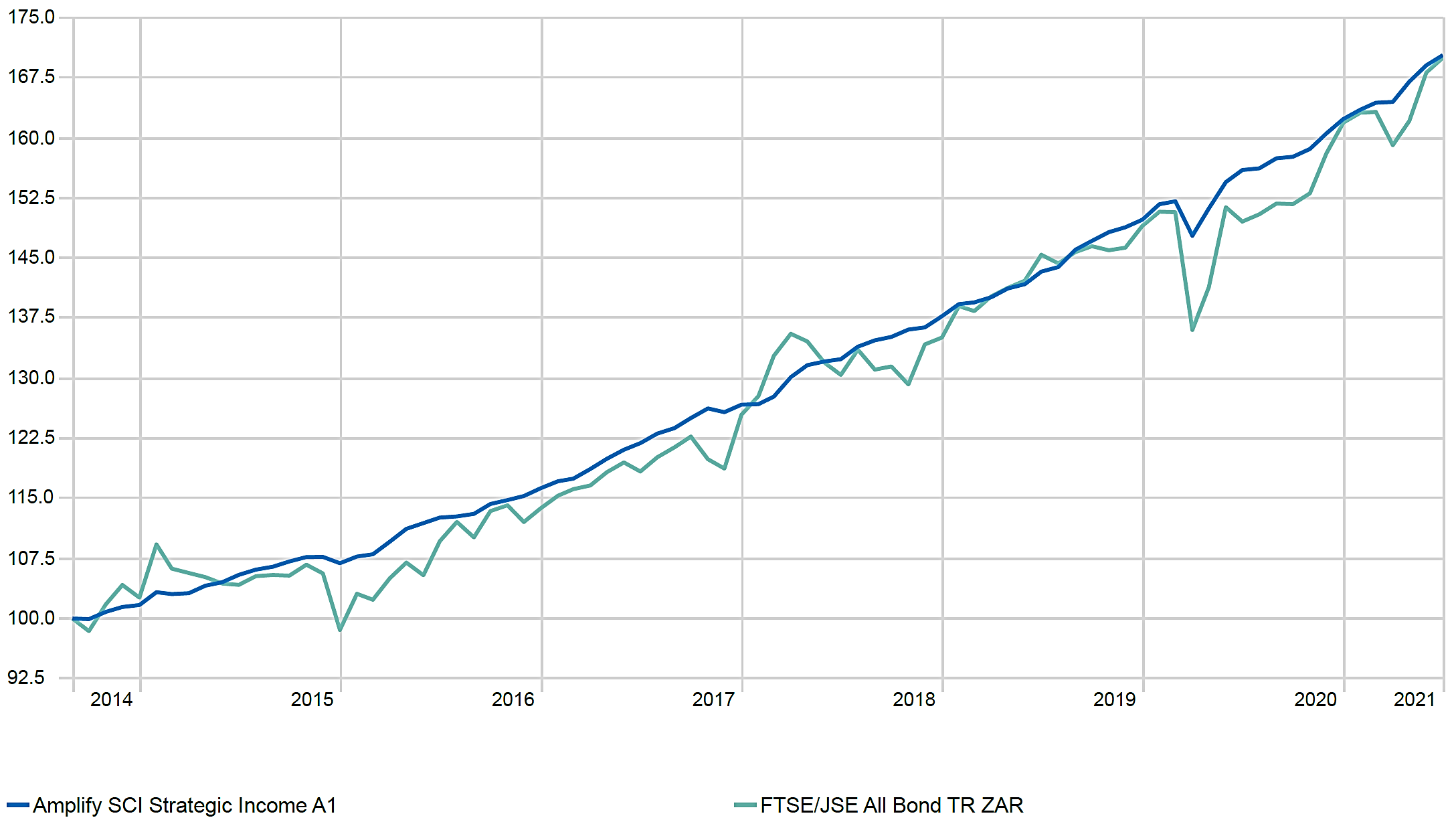

However, even with this level of active management, the duration inside an income fund has a governor, topping out at about half that of their bond fund counterparts. That might frustrate some asset allocators who want to take on more risk. But by identifying and positioning for mispriced assets across their opportunity set, some multi-asset income funds can deliver a level of return beyond the expectations of their cash-plus benchmarks, without the stress that comes with positioning for a single market outcome, while at the same time being competitive against the All-Bond Index.

Of course, the real skill is to make room for that alpha without suffering the volatility that characterises bond fund returns. The income funds that manage to consistently strike such a balance, give asset allocators access to a powerful building blocks to use in their solutions.

What should be clear to everyone is that choosing between an income and bond fund is more complex than just comparing yields. If only it were that simple.

Disclaimer:

Amplify Investment Partners (Pty) Ltd is a wholly-owned subsidiary of Sanlam Investment Holdings and an authorised Financial Services Provider. Sanlam Collective Investments (RF) (Pty) Ltd is a registered Manager in terms of the Collective Investment Schemes in Securities. A schedule of fees can be obtained from the Manager.

| Fund Performance | 1 Year | 3 Years | 5 Years | Since inception | Highest annual return | Lowest annual return |

|---|---|---|---|---|---|---|

| Amplify SCI* Strategic Income Fund |

9.19% | 8.77% | 8.63% | 8.11% | 11.31% | 4.31% |

| Benchmark: STeFI plus 1 |

5.01 | 7.05% | 7.62% | 7.62% | 8.64% | 5.15% |

Maximum fund charges include (incl. VAT): Manager initial fee (max.): 0.00; Manager annual fee (max.): 0.58%; Total Expense Ratio (TER): 0.65%. The Manager retains full legal responsibility of the third-party portfolio. The registered name of the fund is Amplify Sanlam Collective Investments Strategic Income Fund.